Keybank Cd Rates

How KeyBank’s CD rates compare. Unfortunately, KeyBank’s CDs fall short compared to the best offerings out there. Even with the Relationship Rewards rates, competitors still offer higher rates and lower deposit minimums. However, where KeyBank shines is their short-term CDs. You must first have or open a checking account and enroll in KeyBank Relationship Rewards. Clients with Key Advantage Checking, Key Privilege Checking, or Key Privilege Select Checking are eligible for a higher Relationship Reward APY rate. Minimum balance for the Short Term CD account is $2,500. Terms go from 7 days to less than 6 months.

Key Bank has over 1,200 locations across 16 states, with over 1,500 ATMs. It offers a range of checking and savings accounts, including a free checking option. Some relationship products offer perks like lower loan rates and higher savings APY.

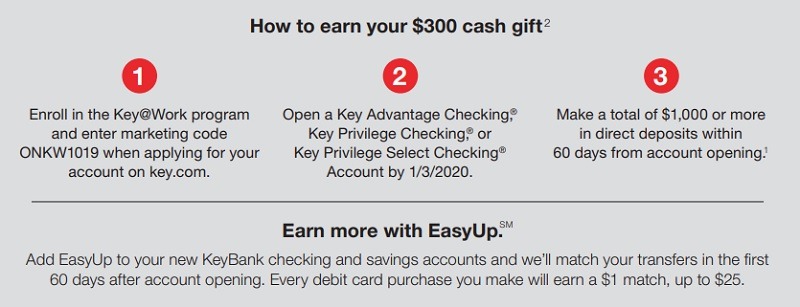

Checking Account Bonuses

KeyBank frequently offers cash bonuses for new checking customers. Some deals are only available for residents of select cities, so make sure you read the fine print carefully.

Special Checking Account Features

All KeyBank checking accounts offer these unique features, in addition to free online banking, bill pay, and mobile deposits:

- HelloWallet financial tools. This tool helps you manage your money and reach your goals. It lets you see where you spend the most money and how much budget you have left. It even lets you see the entire picture of your finances - even non-KeyBank accounts. You get a Financial Wellness score, and as you change your money habits, you'll see how your score changes.

- Overdraft protection. To help pay for overdrafts, KeyBank offers a few options. You can link a KeyBank savings or money market account, apply for a KeyBank Preferred Credit Line, link a KeyBank credit card, or link a KeyBank Home Equity Line of Credit to your checking account. If you overdraft on your checking account, KeyBank will take the funds from your linked account.

An overdraft protection transfer fee may apply (and credit line interest rates), but you'll save on overdraft or non-sufficient funds fees.

- Text banking. When you opt in to text banking, you can text specific commands to check your account balance and get history of recent transactions.

Key Bank Cd Rates Ct

Key Bank Cd Rates Cleveland Ohio

Key Bank Cd Rates Washington State

How to Avoid KeyBank Checking Account Fees

Key Bank Ira Cd Rates

- Hassle-Free Account. This is KeyBank's free checking option. This account has no service fees and no minimum balance requirements. The minimum deposit to open is $10.

- Key Express Checking. The $7 monthly service fee can be waived if you: make at least 8 transactions per month (deposits, withdrawals, transfers), OR have at least $500 in deposits per month.

- Key Advantage Checking. The $18 monthly service fee can be waived if you: maintain a combined balance of $10,000 across all deposit and investment accounts, OR have a KeyBank originated mortgage and have automatic payments of at least $500, OR are a Key@Work program member and have at least $1,000 in direct deposits per month.

- Key Privilege Checking. The $25 monthly service fee can be waived if you: maintain a combined balance of $25,000 across all deposit and investment accounts, OR have a KeyBank originated mortgage and have automatic payments of at least $500, OR are a Key@Work program member and have at least $2,500 in direct deposits per month.

- Key Privilege Select Checking. The $50 monthly service fee can be waived if you: maintain a combined balance of $100,000 across all deposit and investment accounts, OR are a Key@Work program member and have at least $5,000 in direct deposits per month.

- Key Student Checking. The $5 monthly service fee can be waived if you: make at least 5 transactions per month (deposits, withdrawals, transfers), OR have at least $200 in deposits per month.