Ecb Deposit Rate

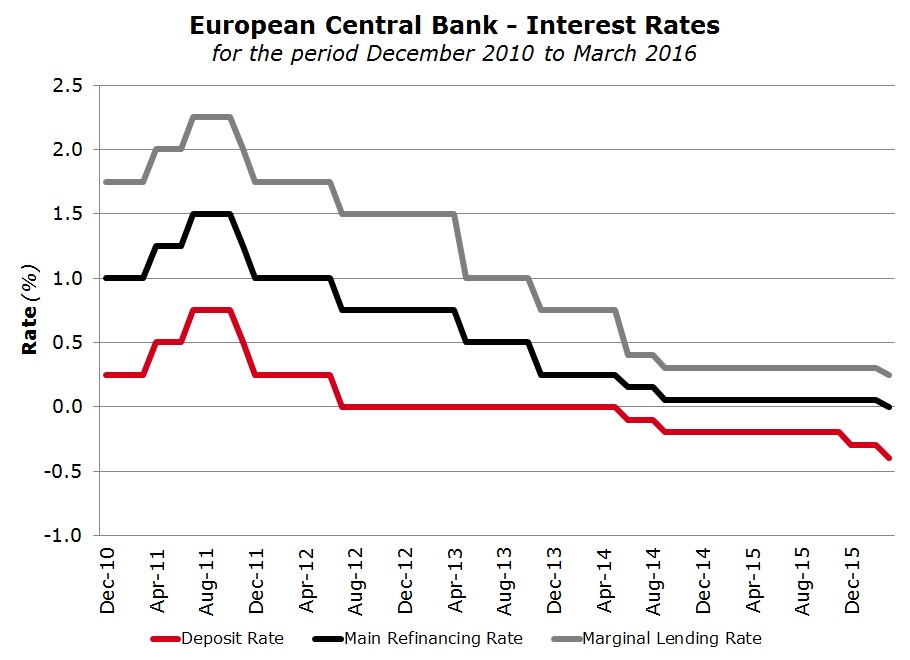

Let’s start at the beginning. The main key ECB rate is the refinancing rate. At the time of writing, the ECB refinancing rate is 0.050%, its lowest level ever. What does this 0.050% rate mean?

To keep the prices stable (inflation below, but close to, 2%) the European Central Bank uses several monetary policy instruments to steer interest rates and manage banking liquidity. The most traditional operations are what we call the Main Refinancing Operations (MRO). When liquidity is needed, a bank can borrow directly from the ECB. Every week, banks of the Eurozone go (virtually) to the ECB desk to borrow money at the refinancing rate fixed by the ECB (0.050%). The loan is made under the form of a Repurchase Operation (Repo). The bank sells security assets to the ECB and borrows money. One week later, the bank gives the money back with interest to the ECB and recovers its security assets.

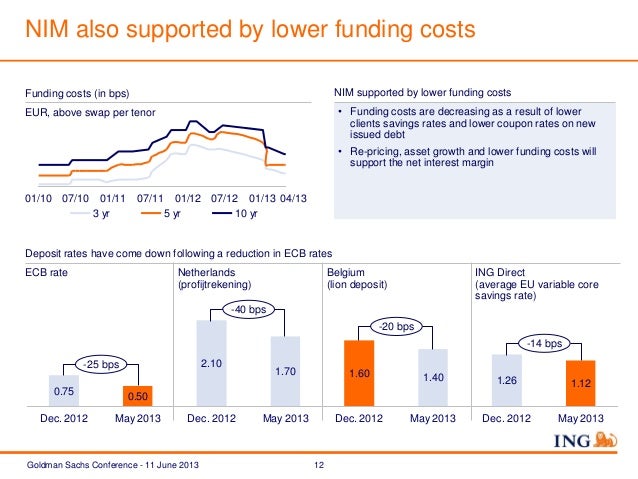

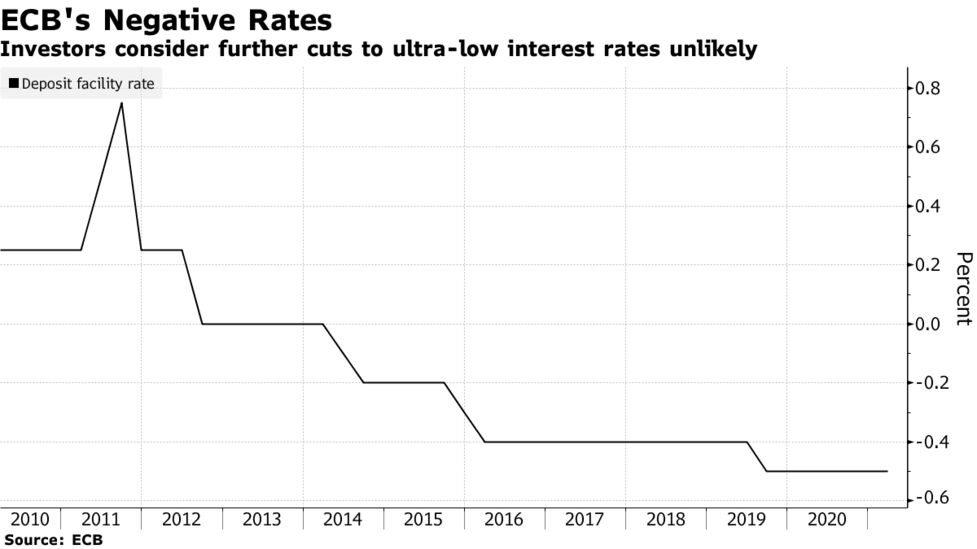

In April 2011, the ECB raised interest rates for the first time since 2008 from 1% to 1.25%, with a further increase to 1.50% in July 2011. However, in 2012–2013 the ECB sharply lowered interest rates to encourage economic growth, reaching the historically low 0.25% in November 2013. The ECB last cut its deposit rate in September 2019, to -0.50%.

The two other key ECB rates are the overnight deposit rate (-0.20%) and the overnight marginal lending rate (0.30%). The first is the interest rate paid by the ECB to banks having a deposit (for the moment, it is the opposite because the rate is negative). The second is the rate paid by banks to the ECB when they want to use overnight credit outside the refinancing operations.

Jens Weidmann, European Central Bank (ECB) Governing Council member and Bundesbank President, said on Wednesday that the ECB’s Pandemic Emergency Purchase Programme (PEPP) is flexible.

Additional takeaways

What Is The Ecb Deposit Rate

“Deposit rate cut is one of ECB’s tools.”

“The size of the yield moves is not particularly worrisome.”

“ECB looking at conditions beyond government bond yields.”

Market reaction

The shared currency remains on the back foot following these comments and continues to weaken against its major rivals. As of writing, the EUR/USD pair was down 0.32% on the day at 1.2050.